Best Credit Card Rewards To Foster More Loyal Customers

- Posted on April 5, 2023 by Robert

- Reading time about 9 minutes

Today’s generation of customers has less brand loyalty than the previous generation and it is estimated that 78 percent of customers are not loyal to any particular brand. Therefore, it becomes more important for banks and financial institutions to make an effort to deliver the best rewards and deals to consumers and win repeat business.

Loyalty programs are one proven way to accomplish this. Customers enrolled in loyalty programs and are sold on the benefits of a loyalty system; they actively seek out opportunities to use it. A rewards credit card is a good addition to customers’ wallets and should largely depend on their spending habits. In this article, we will discuss how loyalty programs for financial institutions and banks help you in delivering the best rewards and maintain customers’ loyalty.

Best Credit Cards Reward Programs

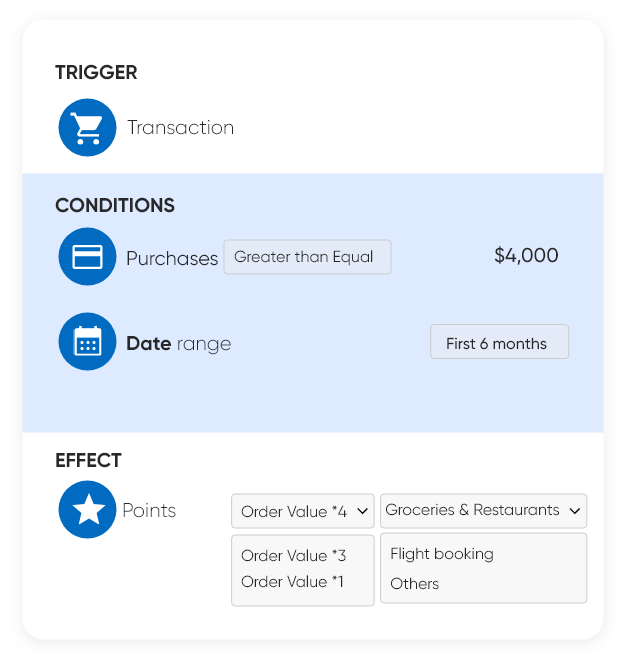

1. American Express® Gold Card

The best credit card to earn reward points. This card offers you 60,000 membership reward programs to users when they make $4,000 purchases in the first 6 months. Customers can earn 4X membership rewards points on groceries and restaurants, 3X points on flight booking, and 1X points on all other purchases.

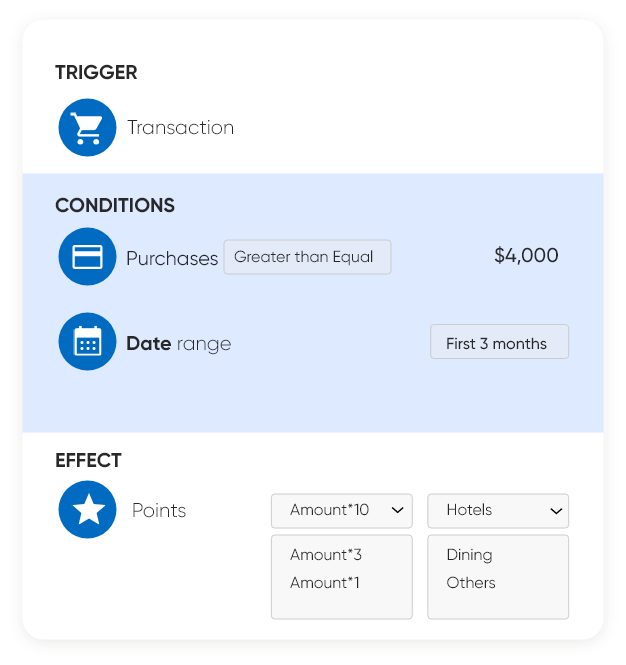

2. Chase Sapphire Reserve®

Enjoy elevated rewards for all your travels. Earn 60,000 bonus points ($900) when you spend $4,000 on purchases in the first 3 months. The ultimate rewards points to its customers can be redeemed on travel and other shopping experiences. Thus, it offers 10X points on hotels, 5X points on flights, 3X points on dining, and 1X point on all other purchases.

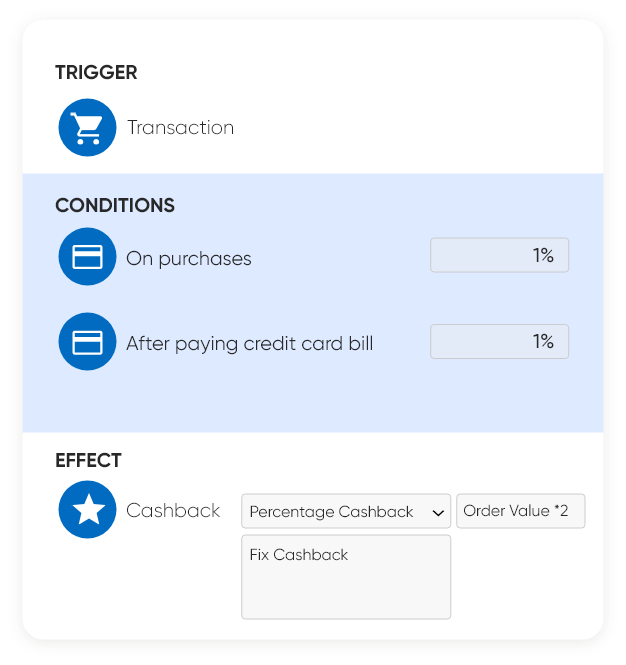

3. Citi Double Cash Card

Citi offers double cash cards at no annual fee. You can earn 2% cash back in total: 1% on all purchases and an additional 1% after you pay your credit card bill. You can redeem points for cash back as a statement credit, direct deposit, or mailed check. You can also redeem points for gift cards and travel, or shop with points at major online shopping sites.

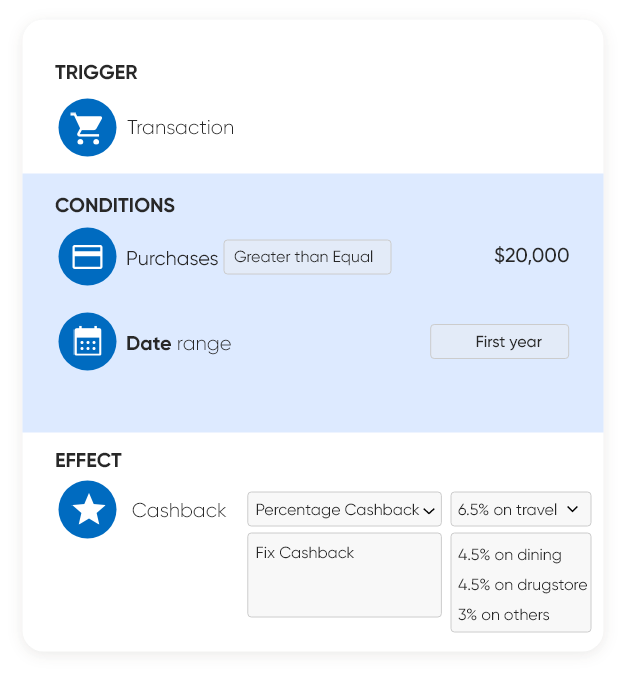

4. Chase Freedom Unlimited Card

The best credit card to enjoy unlimited benefits. Earn an additional 1.5% (up to $300 cash back) on all purchases when you spend up to $20,000 in the first year. You can earn cashback of 6.5% on travel, 4.5% on dining at restaurants, 4.5% on drugstore purchases, and 3% on all other purchases. Thus, you get all the benefits at no annual cost.

5. Amazon Prime Rewards Visa® Signature Card

If you love online shopping, then Amazon Prime Rewards Visa® Signature Card is just curated for you. If You join a Prime membership, then you are eligible for 5% cashback at Amazon and Whole Foods Market while non-prime customers get only 3% cashback. You can also earn 10% back or more on a rotating selection of items and categories on Amazon.

6. Capital One Venture Rewards Credit Card

Venture Reward from capital one is the top credit card that you can consider for all your expenses. You can earn 75,000 bonus miles on spending $4,000 within the first 3 months. Earn unlimited 2 miles per dollar on every purchase and earn 5 miles per dollar on hotels and rental cars. You can redeem miles to get reimbursed for past travel purchases and enjoy 2 free lounge visits per year.

Why Choose Loyalty-based Credit Cards?

We all know, loyalty programs act as a marketing strategy that rewards loyal customers who frequently engage with a brand. These are designed to incentivize repeat purchases by providing customers with various discounts, rewards, unique offers, VIP events, and more. Thus, it has the potential to attract new customers, retain existing customers, reactivate dormant customers, and nudge them to spend more.

Loyalty programs can be used in many forms, ranging from simple stamp cards to sophisticated point-based reward systems. It has been proven as one of the most effective strategies to deliver rewards to customers and change their spending behavior. Thus, loyalty programs help banks and financial institutions to deliver the best credit card rewards program that can drive customer retention, boost customer lifetime value, and inspire loyalty.

Build The Best Credit Card Rewards Program with Novus Loyalty

Novus Loyalty is the best cloud-based loyalty program for financial institutions, credit unions, insurance, and banks. We help you in developing the best deals, rewards, and loyalty point-based systems for your customers when they make a purchase of credit or debit cards. Our loyalty program fuels banks and financial institutions and accelerates customer spending and retention alongside fostering long-term loyalty and customer engagement.

Delivering the right credit card rewards and deals to customers that can fulfill all their needs and demands is still a dream of banks and financial institutions. Picking the right credit card feels overwhelming to customers. To relieve this stress, we have curated the best card-based loyalty program by understanding the spending habits, budget, and drawbacks, and digging into each card’s perks to deliver the best credit card rewards program. Let us see how Novus loyalty helps you in curating the best deals and rewards for your customers.

1. Points-Based Rewards

Integrate points-based customer loyalty rewards programs using a different set of earning rules to reward customers for every purchase, behavior, or regular interaction for enhanced retention rate and engagement. Points-based loyalty program is the best credit card rewards program to reward customers for every purchase or regular interaction for enhanced retention rate and engagement.

Benefits

Set Earning Rules

You can easily define how many points can be earned based on transactional details. You can easily curate the points whether you want to deliver – 2X, 3X, or 4X reward points based on the customers’ spending. Easily integrate earning rules based on time, segment, location, and numerous other aspects.

Higher Perceived Value

Most customers consider point-based rewards a great deal to save additional money. This delivers a higher perceived value than their actual cost.

Points For Online and In-Store Purchases.

Customers need to identify themselves through registration or loyalty cards to start getting rewarded with these earnings which are possible for both online and in-store purchases.

Transfer/Redeem Points

Allow your customers to spend points anywhere or in multiple ways to use their points to redeem in multiple ways including offers, gift cards, flight booking, and many more in a row.

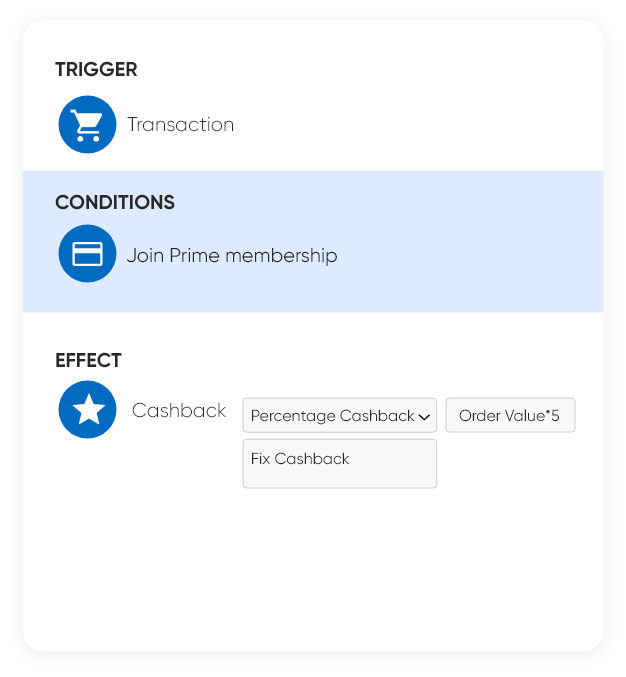

2. Cashback Reward Program

Cashback & discounts reward loyalty programs instantly incentive your customers and allow you to engage & retain customers. Many banks and financial institutions are using cashback and discounts to reward customers with their card-based loyalty programs. Most banks, financial institutions, and credit unions let you earn a certain percentage of cashback, fixed cashback, and other discounts based on your spending.

Benefits

Increased Sales

Cashback is an amazing option to engage customers and encourage them to make repeat purchases. Thus, by giving customers a chunk of their spending, you can boost your sales.

Encourage Customer Loyalty

Discounts and cashback make customers feel more valued. When customers receive various perks from the businesses then it fosters their loyalty and keeps them coming back for more.

Measurable Benefits

Loyalty programs for financial institutions accelerate business growth, provide detailed reporting, and have a smart customer database catering to all information in a single place.

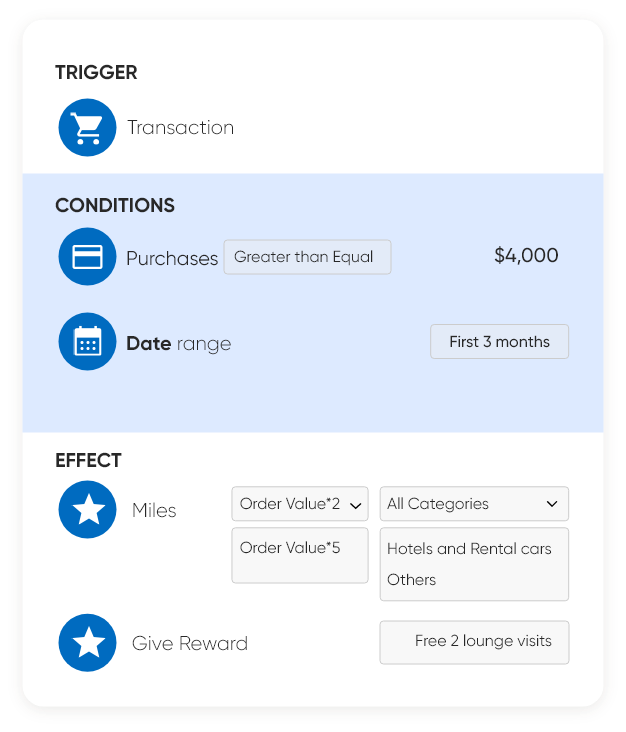

3. Miles Credit Reward program

Miles or air miles is a type of loyalty program that can be crafted for customers who like to travel and get rewards for flights, hotels, and other bookings. Many banks and credit unions deliver card-based loyalty programs and promotional offers like airport lounge access, seat upgrades, and other travel-related preferences for customers.

Most banks, credit unions, and financial institutions tie up with airline companies to offer miles as part of the brand’s unique membership rewards program. Banks and credit unions merge with airline companies and deliver co-brand miles rewards to customers. For example, American Express merged with Delta Airlines and is offering “SkyMiles” on the Delta SkyMiles Blue American Express Card. Customers can earn 10,000 bonus miles after spending $1,000 in the first 6 months, 2X miles on dining takeout and delivery in the U.S., 2X miles on Delta purchases, and 1X miles on other purchases.

Chase Sapphire Reserve is another favorite card that travel lovers want to consider for earning points and rewards. Customers can earn 5X points on flights, 10X points on hotels and car rentals, 3X points on other travel and dining & 1 point per $1 spent on all other purchases.

Benefits

Deliver Free Tickets

Miles credit points allow you to reduce the cost of customers’ travel or offer them free tickets and stays. Card-based loyalty program is the best way to deliver free tickets on defined spending.

Drive Better Customer Loyalty

You can drive better customer loyalty by delivering special benefits to the customers. Delivering them the best offers on luxury travel, hotel & resort collection helps you in converting them into more loyal customers.

More Saving To The Customers

You can reward your customers every time they make a transaction. Offer them the best credit card rewards program and earn more profit and sales.

Final Words

Do you want to deliver the best credit card reward to customers to raise brand awareness using a modern IT technology solution to accelerate your loyalty among potential customers? Novus Loyalty is an end-to-end loyalty software solution provider that helps you in developing the best credit card rewards for your customers. However, our SaaS-based Loyalty platform has the potential to curate a mix of cash back, points, and miles cards each from a credit card reward. Thus, with an engaging loyalty program for financial institutions like- Novus Loyalty, you can easily maintain customers’ loyalty and keep them retained through interactive deals and offers.